Introduction: Why Weird Money Tips Actually Work Ever tried saving money and failed by day three? You’re not alone. The usual “cut down on coffee” advice is boring—and let’s be honest, ineffective. That’s why we’re here with a weird way to save. Strange, unconventional, even slightly embarrassing—but it works. Ready to weird your way to savings? Let’s go.

- Understanding the Psychology of Saving Money

- The 30-Day Weird Money Challenge Overview

- Week 1: Strange Spending Hacks to Kickstart Savings

- Week 2: Unusual Saving Methods for Daily Habits

- Week 3: Weird Money Tips That Work Like Magic

- Week 4: Bizarre Yet Effective Final Stretch

- Bonus Weird Tips to Boost Results

- Tracking Your Progress the Weird Way

- Mindset Shift: Becoming Proud of Being Weird with Money

- Conclusion: Embrace the Weird, Reap the Rewards

- FAQs

Understanding the Psychology of Saving Money

Why Traditional Saving Methods Fail

Traditional saving is like starting a diet on Monday—it sounds good but rarely sticks. Why? Because it doesn’t feel rewarding right away. Unusual savings tips spark curiosity, add a sense of fun, and deliver surprises—keeping your brain engaged and motivated.

The Power of Behavioral Tricks

Behavior beats logic when it comes to money. Tricks that make you laugh or challenge you trigger new habits faster. Weird = memorable. Memorable = effective.

The 30-Day Weird Money Challenge Overview

How This Challenge Works

For 30 days, you’ll complete one weird savings tip per day or a small challenge spread over a few days. These aren’t your grandma’s budgeting methods—these are tricks that make you pause, laugh, and say, “Wait… this might just work.”

What Makes These Tips ‘Weird’?

Anything unconventional. Things like freezing your credit card in a block of ice or wearing three shirts at once to avoid shopping—yeah, we’re going there.

Week 1: Strange Spending Hacks to Kickstart Savings

Day 1-3: The Reverse Shopping List

Before heading out to shop, jot down what’s already in your home—not what you plan to buy. To stay organized, use a magnetic grocery list pad on your fridge.

Day 4-6: The ‘Ugly Jar’ Trick

Put an old, ugly jar on your kitchen counter. Want something fancy? Give this Hilarious Swear Jar a go—it turns saving money into a comedy act.

Day 7: No-Spend Rainbow Challenge

Pick a color. For the whole day, you can’t buy anything that comes in that color packaging. Ridiculous? Yup. Fun? Definitely.

Week 2: Unusual Saving Methods for Daily Habits

Day 8-10: Shower Time Saving Game

Time your showers. For every minute under five minutes, put $1 into savings. Want to keep track? Use this waterproof shower timer.

Day 11-13: The Coin Toss Challenge

Flip a coin before any online purchase. Heads—you can buy. Tails—you wait 48 hours. Get a cool collector’s challenge coin to make it fun.

Day 14: Freeze Your Cards—Literally

Put your credit card in a bowl of water and freeze it. Need a good container? Check out these reusable silicone freezer containers.

Week 3: Weird Money Tips That Work Like Magic

Day 15-17: The Grocery Store Left-Turn Rule

When entering a grocery store, always turn left first. It keeps you away from the high-margin temptation zones.

Day 18-20: The Envelope Full of Lies

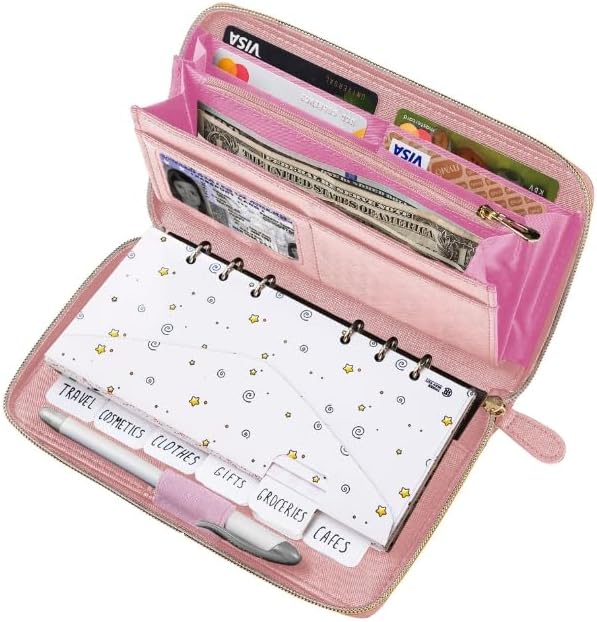

Write random amounts on envelopes. For a pro touch, grab this Cash Envelope Budget System Kit.

Day 21: The ‘Wear Everything You Own’ Day

Dig out old clothes and wear mismatched outfits for one day. It’s weird, yes. But it breaks that “I have nothing to wear” shopping spiral.

Week 4: Bizarre Yet Effective Final Stretch

Day 22-24: Declutter Sale Day with a Twist

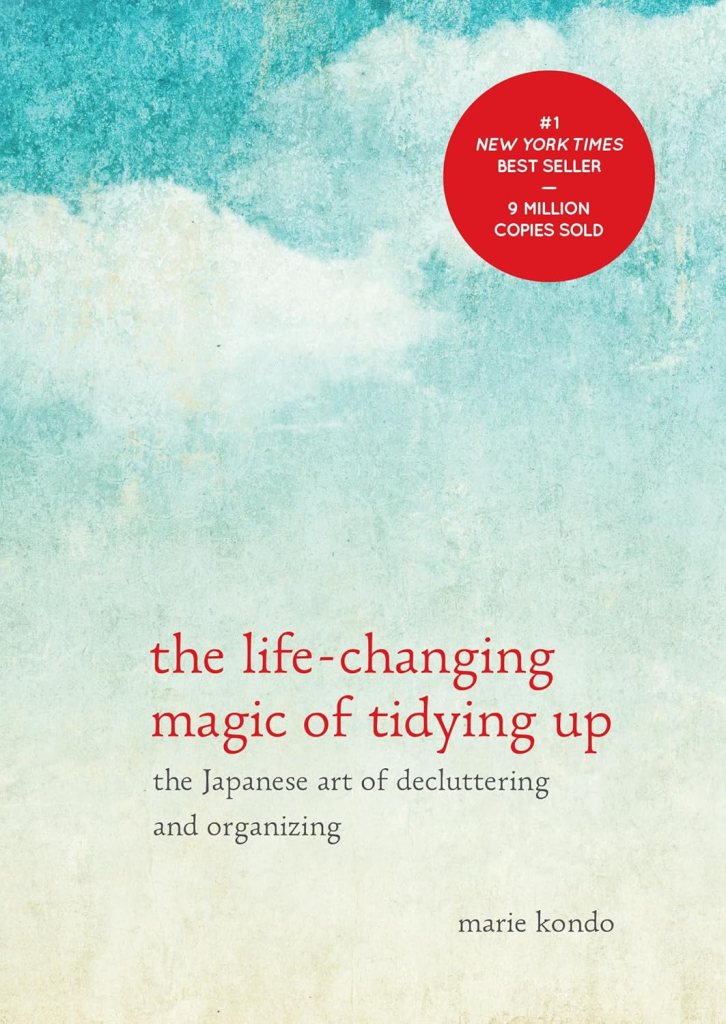

Sell at least five things you don’t use. For help, check out The Life-Changing Magic of Tidying Up for decluttering tips.

Day 25-27: Leftover Meal Lottery

Write down random ingredients in your fridge. Pick three blindly and make a meal. Feeling adventurous? Use Foodie Dice for inspiration.

Day 28-30: Social Media Detox = Wallet Growth

Every hour you don’t spend scrolling, transfer $1 to savings. Boost your productivity with a Productivity Planner.

Bonus Weird Tips to Boost Results

- Grocery Store ‘No Basket’ Rule: No cart, no basket—if you can’t carry it, don’t buy it.

- Cash-Only Fun Days: Leave your cards at home one day a week.

- Soundtrack Challenge: Make a playlist of sad songs. Listen before online shopping. Emotional purchases? Stopped cold.

Tracking Your Progress the Weird Way

Use sticky notes on your fridge tallying up what you’ve saved each week. Is the total rising with glowing pink slips? Weird satisfaction unlocked.

Mindset Shift: Becoming Proud of Being Weird with Money

Forget what other people think. Weird is the new rich. The ones saving weird today are the ones affording vacations tomorrow.

Conclusion: Embrace the Weird, Reap the Rewards

By now, you’ve realized saving money doesn’t have to be painful—it can actually be hilarious. The stranger the savings trick, the more effective it tends to be. If you can laugh and grow your savings at the same time? That’s a win-win.

So, go ahead—embrace the weird, build your stash, and enjoy the ride. Your future self will thank you.

FAQs

Can weird savings tips really save me money?

Absolutely. Weird tricks break your usual habits and force you to think before spending. It’s like tricking your brain into doing better things for your wallet.

What’s the weirdest tip that actually works?

Probably freezing your credit cards. It’s so ridiculous you won’t forget it—and it stops impulse buying cold. Literally.

How much can I expect to save in 30 days?

It depends, but many people manage $100–$500 or more, depending on how seriously they take the daily challenges.

Is this challenge for families too?

Totally! Kids love the rainbow challenge and leftover meal lotteries. It can become a fun family game night.

Can I repeat the 30-day challenge again?

Heck yes. Mix it up with your own weird ideas and see how far you can go.

Please don’t forget to leave a review.

Leave a comment